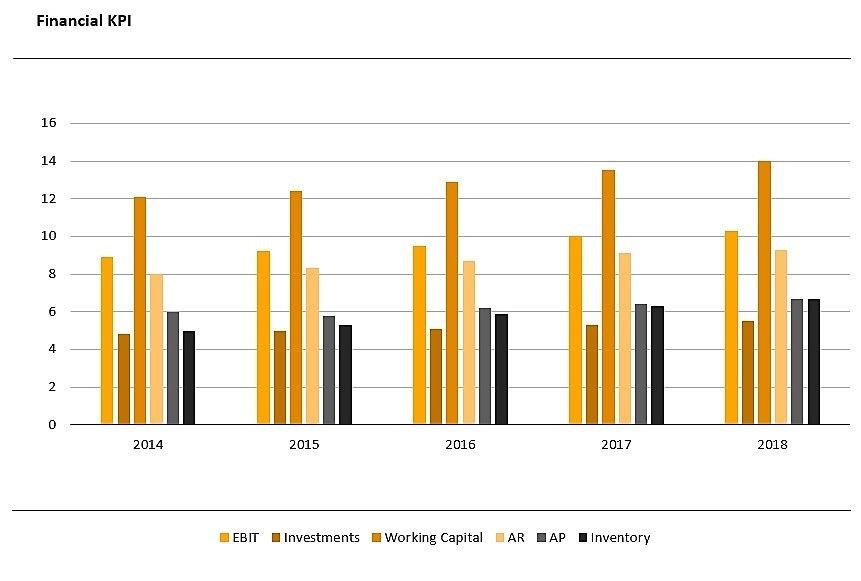

Financial KPI

Posted on |

Financial KPI

Financial KPI – Financial Key Performance Indicator is the most efficient way to keep track on organization’s business performance. It is a measurable value that demonstrates how effectively a company is achieving organization’s overall financial health mainly generating revenue, profits, cash flow and working capital.

Gross Profit Margin

Gross profit margin factors in the cost of sales while calculating the gross profit. The gross profit margin indicates whether a business is capable of paying its operating expenses while having funds left for growth. Formula is –

Gross Margin = Revenue – Cost of Sales

Net Profit Margin

Net profit margin factors gross margin as well administration expenses. Higher the net profit greater the efficiency of the organization The formula of Net profit margin is –

Net Profit Margin = Revenue – All Costs (variable, fixed, administrative)

Working Capital

Working capital means current assets less current liabilities, in short, it’s immediately available cash in the business. The major parameters to calculate working capital are accounts receivable, other external receivables, inventory, accounts payable, other external payable.

Working Capital = Current Assets – Current Liabilities

Internal Rate of Return (IRR)

The internal rate of return (IRR) is used to estimate the profitability of the project / potential investments. The internal rate of return is a discount rate that makes the net present value from all cash flows equal to zero.

Net Present Value (NPV)

NPV is the measurement of profit calculated by subtracting the present values of all cash outflows from the present values of cash inflows over a period of time. The internal rate of return (IRR) is the discount rate often used in capital budgeting that makes the net present value of all cash flows from a particular project equal to zero. Generally speaking, the higher a project’s internal rate of return, the more desirable it is to undertake the project.

Inventory Turnover

Inventory turnover shows how many times inventory is sold and replaced over a period of time. It is calculated as sales divided by average inventory, alternatively, it is calculated on the basis of COGS divided by average inventory.